I wrote this long essay at full tilt because it was boiling away in my brain over this past week, with all of its absurdities. If you want a coherent explanation of what’s going on with GameStop, Reddit, Robinhood, and stock manipulation, try Taylor Lorenz’s New York Times article. Here’s a Twitter thread. This newsletter will take a slightly different approach to the subject: anecdotal, abstract, invested with the full grudge of the impossible 21st-century economy that we have the misfortune of living through.

If you haven’t seen this before, this is my (Kyle Chayka) personal newsletter where I send out new writing updates and original essays.

The meme economy, or, a personal journey through 21st-century capitalism

During my first years of high school, I was obsessed with an online role-playing game (MMORPG for the nerds) called Ragnarok Online. Like any such game, it had various roles you could choose to play as, alongside millions of other players: knight, wizard, thief, archer, priest. But there were also merchants.

Every MMORPG is also a kind of digital marketplace where various goods are exchanged: Players earn in-game money and spend it on in-game items, mostly stuff like weapons, potions, or special armor. You fight monsters, which drop loot, which you then sell to the game’s automatic (NPC) stores in exchange for currency, which you can use to buy new gear. Ad infinitum: that’s pretty much the whole game, the slow accrual of digital money and increasingly expensive items.

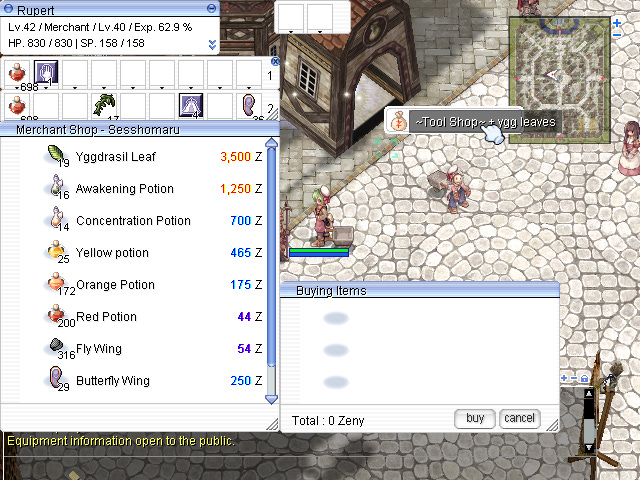

But the merchants’ role in the game, rather than just fighting monsters, was arbitraging that exchange of items. If you were a merchant, you could sell loot to the NPC store at an increased rate, buy items for cheaper, and, crucially, set up shops, in the form of dialogue bubbles that pop up over your avatar’s head, to sell to players directly, at prices of your choosing.

Say you’re in a town, and you can buy a dagger from the game’s store for 20% off the normal price. The strategy was to set up your shop right outside the actual store and offer the dagger for cheaper — say, a 5% discount. Then you pocket the difference. It was a volume game, of course: You had to sell dozens of daggers at a time to make much money, and therefore needed enough capital upfront to buy them from the store and create your slim margin of profit, which you reinvested into more items.

That’s what I did! And it was more fun to me than hunting giant monsters or whatever. Oftentimes you’d get crowds of merchants in front of a store, maybe offering different wares or undercutting each other’s prices until one player got up and left — then the remaining merchants could raise their prices and increase their profit margins again.

This cycle should have been my first lesson of the crunch of post-industrial capitalism that I have been spending the rest of my life in: Not only were we competing on supply and demand, we were doing so in a fictional economy where the scarcity of the objects at hand was completely artificial, just pixels and calculated drop rates that could be tweaked at will by the company that owned the game. The economy, the desirability of one set of pixels over another, was arbitrary.

For example: During the holidays, there would be monsters wearing santa hats, and you kill the monsters, collect the santa hats, and wear them on your avatar, but after the week of Christmas they got turned off, the coveted object vanished until next year when they would be coveted once more. More fakery: I sometimes used an external bot program to maneuver my character through the game and level up while I was sleeping. I didn’t think much of cheating because we players were just doing this for fun. In the 2000s there was no actual link between U.S. dollars and the virtual goods in the game; the reward was pride or clout in your in-game objects, your Ragnarok career.

Unfortunately I didn’t learn that lesson of arbitrary digital capitalism very well, otherwise maybe I’d be rich right now. I only took economics classes for the first time in college, figured out supply curves, tariffs, import-export balances, currency exchange rates. It seemed significant at the time, for my study of International Relations. When I graduated I looked for a job that would pay me an annual salary with the understanding that that was how one made a living, with checks every two weeks sent from an entity on high known as the corporation. Of course, in the real financial-crisis world of 2010, I first got an internship with a tiny stipend of Chinese Renminbi and then I got paid under the table. At this point I’ve worked for myself for a decade. The whole salary thing never materialized.

Now I realize that Ragnarok taught me more than almost anything else in my life about money and profit in our time. The lesson was that the santa hats are everything, that digital scarcity is often more important than physical, that it is almost always better to have your hands on the capital rather than the job: to be a merchant, not a worker.

My experience as a working adult in the economy has been made up of a series of shocks, or perhaps negative epiphanies. My parents made their living on salaries as engineers and schoolteachers; it wasn’t that they didn’t own stock or participate in the stock market, but I don’t think I understood the idea of capital, or equity in the means of production, until — like so many things — I felt the full sweep of it in my own life.

Since I wrote about art at the outset of my career, maybe the first thing I noticed was the ballooning price of young artists’ work, when a few gallery shows or the right attention could mean what once sold for $1,000, or was given away freely, was suddenly worth $100,000. (Interviewing for a gallery internship that I didn’t get, I once sat on a chair next to another with a Rothko canvas casually leaning on its seat. At another moment I visited the country house of the young, old-money dealers who represented an artist friend; they took an ancient Roman statuette off their mantle and tossed it around.) The proximity to money in the art world didn’t entail much chance of it rubbing off; you either had so much of it you could afford the nonfunctional luxuries for sale or you desperately needed more of it to keep making them.

The next shock was the resurgence of Silicon Valley in the 2010s as an engine of vast wealth for people my age or younger. An early employee in the right tech company, who might just be a workaday developer with the right friends, accrues a small slice of equity in a business that is suddenly worth billions of dollars, because it has replaced a previous filter in some massive capital flow — Google monopolizing advertising, for example. The company goes public or gets acquired and that tiny slice is worth millions in turn: the employee is instantly wealthy, not because of their salary or the significance of their work but their participation in the blast furnace of software eating the world. An early enough employee at Tumblr, even one working on the editorial side, came away from that company’s $1.1 billion sale to Yahoo (lol) in 2013 with hundreds of thousands of dollars. A small sum for tech, but more money than I am likely to see at once in my life, which was also true for my parents and my grandparents before that.

Let’s call cryptocurrency my third shock. Currencies like Ethereum and Bitcoin are arcane equations using up overwhelmingly huge server resources in order to maintain an unbreakable level of digital scarcity: like Ragnarok santa hats that are actually gold and can’t be shut off for the holidays, but there are only ever 1,000 of them and you trade in hat fractions. As a journalist, I watched as these mutations of capital emerged and became worth a few dollars. Interesting! A weird experiment in digital money. Then they rose exponentially. A few dollars in the early 2010s became worth tens and then hundreds of thousands of dollars. People who bought Dark-Web LSD became millionaires. I imagine it feels the same way to me that people felt when Gutenberg started printing bibles in the 15th century: from nothing, something that we once thought was sacred was produced seemingly infinitely, and the world was never the same. It broke some unstated societal framework.

I can’t regret not buying in to Bitcoin or whatever early because I can’t comprehend what that money would mean for me. I have no significant problems in my life, no lack of serious opportunity that the money would solve. I can’t buy my own real estate in major cities, but for the standards of our time, I am totally fine. Yet as those magic numbers flooded into certain accounts, I know people who have become secretive stewards of mysterious venture funds who wouldn’t have to work another day in their lives if they chose not to. I suppose that is the real change that money could make for me: a sense of safety against the future, which currently seems more threat than opportunity. If you bought Bitcoin then you can afford water rights in 2050, or maybe jumping the COVID-19 vaccine queue.

The same thing happened again last week: A cabal of small-time stock-traders on Reddit, acting on careful research and in line with the bets of at least a few major hedge funds, sent the stock of GameStop, an outdated video game retailer with the same sense of 2000s nostalgia as Ragnarok, soaring to 10x, 20x its price a few weeks ago. Other hedge funds were betting against the stock and had to buy in as it rose. It was the little guys against the corporate overlords, but some of the little guys were still getting rich. If I somehow knew the tip, would I have put $10,000 into GameStop? Would I have gotten out at the right moment? The $200,000 profit is more than I’d probably make in 4 years.

What still shocks me about money is that there is both so little and so much. It exists at the level of affording a cup of coffee at the same time as Airbnb cofounder Brian Chesky’s net worth ascending into the billions when his company IPO’d (while he was on television, a video I can’t stomach watching), or as Jeff Bezos profits from the civilizational paralysis of quarantine via Amazon. These men have more money than they could ever spend — you could call it dynastic wealth at this point, like the pharaohs — and they can’t throw cash at literal space travel fast enough to even slow their fortunes’ growth. The accrual of a salary, a family’s health insurance policy or a cup of coffee, counts for nothing in the face of such vast inequality.

I’m not out to denigrate anyone’s work; I know that it takes as much skill and awareness as luck to notice the right opportunity, take it, and survive until it’s possible to cash out. You also have to pay taxes, unless you figure out a route around that, too, of which there are many in America. And it’s not like I don’t value what I’ve been doing this past decade, sitting at my laptop, noticing things and writing about them, assembling the data points of a personal worldview and trying to share it with other people — work that necessarily entails a degree of narcissism. I could have chosen to be a private equity banker or moved to San Francisco for the startup lottery; I could have invested in my hunches instead of publishing them for public consumption.

But I describe these phenomena now simply in order to wrap my mind around them, to gauge just how far the world and normal life has moved away from the small-scale expectations that I grew up with, the vague promises that society had made about the meritocracy of education, the pursuit of happiness, the value of hard work, whatever. Since we are forced to, like medieval peasants under a psychotic king, I am attempting to internalize the lessons that capital is teaching me, to perhaps better judge the whipsaw of its momentum in the future. To what end, I’m not sure — to know when it’s likely to buzz my head off so I can avoid it? Or to try and grab hold for myself? Sometimes I don’t think I have any other choice. The dilemma can feel like you’re either holding Amazon and Palantir stock in miniscule amounts and profiting slightly from them screwing you, or you’re just getting screwed.

When we look at what is happening in the economy of digital capitalism, for how long is it even possible to sustain the delusion that wealth somehow means merit, that its recipients deserve it, or that the suffering of so many people in menial jobs without adequate support is somehow necessary? I grew up with the sense that labor is worth money, that it has a steady value. Maybe it does, but the truth is that the not-labor of capital is worth so much more, like a tidal wave compared to a plastic pale of water on the beach. Yet I also think that it has less meaning, if meaning has any value.

The French economist Thomas Piketty published a book called Capital in the 21st Century in 2014 that summarized our problem in one theory: R > G. The rate of return on capital (profits or dividends from companies; rents on things like real estate; interest) has been greater than the rate of economic growth, the overall output of society as a whole or the rewards of labor. It’s easy enough to illustrate: A GameStop retail clerk who used their wages to buy $GME stock a month ago would make many times more money on their stock than in the rest of their month of wages, though they are the reason why the company exists.

That’s a lucky bet, of course, and you’d need a good amount of upfront capital to buy enough stock to profit from its rise. But it’s pure R > G: the labor of running the store, or even the fundamental value of the physical infrastructure the stores run on, means nothing in the face of the random stock trend. And the trend itself is artificial. It’s not based on a perception that GameStop might be worth more money some day because it will be better run; it’s essentially a participatory joke where the joke’s inventors will get rich and its late adopters will lose everything they put in when the inevitable sell-off drives it back to its 2020 stock price. It’s a meme economy, with actual dollars at the end instead of nebulous social-media clout.

GameStop illustrates what we might call the Ragnarok Santa Hat Theory of Digital Capitalism. Money is made not from salary or even slow index-fund gains but identifying the right scarce digital meme at the right time, knowing when to grab the santa hat before it disappears. The return multiples of guessing the right meme are as good as the best venture-capital bets or being an early Apple employee. You need the capital to play the game, but it’s a much lower bar than becoming an accredited investor in the U.S., which requires an annual income of over $200,000 or a net worth of $1,000,000. Other than that, all the meme economy needs is time, snooping, and developing the outlook of the extremely online — which, when I was a kid, was a source of embarrassment and is probably still a psychological dysfunction.

To me, the booms of Bitcoin, GameStop, or working for Facebook are like if I was suddenly paid $100,000 for every santa hat I collected. As if you got rich by knowing which episode of Great British Bakeoff is truly the best one. Excuse me, but, what the fuck? (The art world is already this way, but you have to know the right people IRL and pass the right tests in order to be let in the game.)

Capital is more profitable than labor, and the spikes of capital during the internet era, the crazy peaks of its reproduction rate, have more to do with entertainment, memes, and fandom than with revenue, productivity, or utility.

If my high-school teachers had known this reality they would have sent me back home to the basement to play video games. I used to think that stability was formed by the slow gains of promotions and work, the respect of my peers and the establishment of authority in some field or another, even if not through salaried full-time jobs. My concept of a career has been replaced, however, with the framework of a series of increasingly arcane gambles within the digital platforms that contain our lives and our civilization. Any bet could outpace many years of work.

We hope to land at the right startup, to buy the right coin, to be an early adopter on a new platform just before the audience floods in, to become a meme ourselves. For that is how it works: You go viral, thus you get a gig, get sponsorships, sell subscriptions, sell a book.

Being content with a job sometimes seems like acceding to the invisibility that capital wants (because going unnoticed is more efficient), like forgetting the back-room game exists. Or believing that it all has some more fundamental basis or logic than the appearance and disappearance of pixels in the shape of a santa hat, chased by millions of players in a virtual world.

Usually an essay ends with some suggestion of solutions or a look at the future of problem or industry X, with the aim of leaving the reader some hope and pinning a clean narrative on the world’s narrativelessness. But this is not a traditional publication and I think we are in the midst of this chaos, the ramping up of an era for which we are still identifying the rules. In 2014 the government told us that corporations were people, too. To survive or benefit from the evolving structure of digital capitalism, people must in turn become corporations, marketplaces, platforms, or memes. Because those are the only things allowed to thrive.

I have to be a meme, too: This newsletter is Kyle Chayka Industries by Kyle Chayka. Follow me on Twitter. Read the archive of my writing. Buy my first book, The Longing for Less, on minimalism in art and life. Email me by replying or writing to chaykak@gmail.com.